- Analisis

- Analisis Teknikal

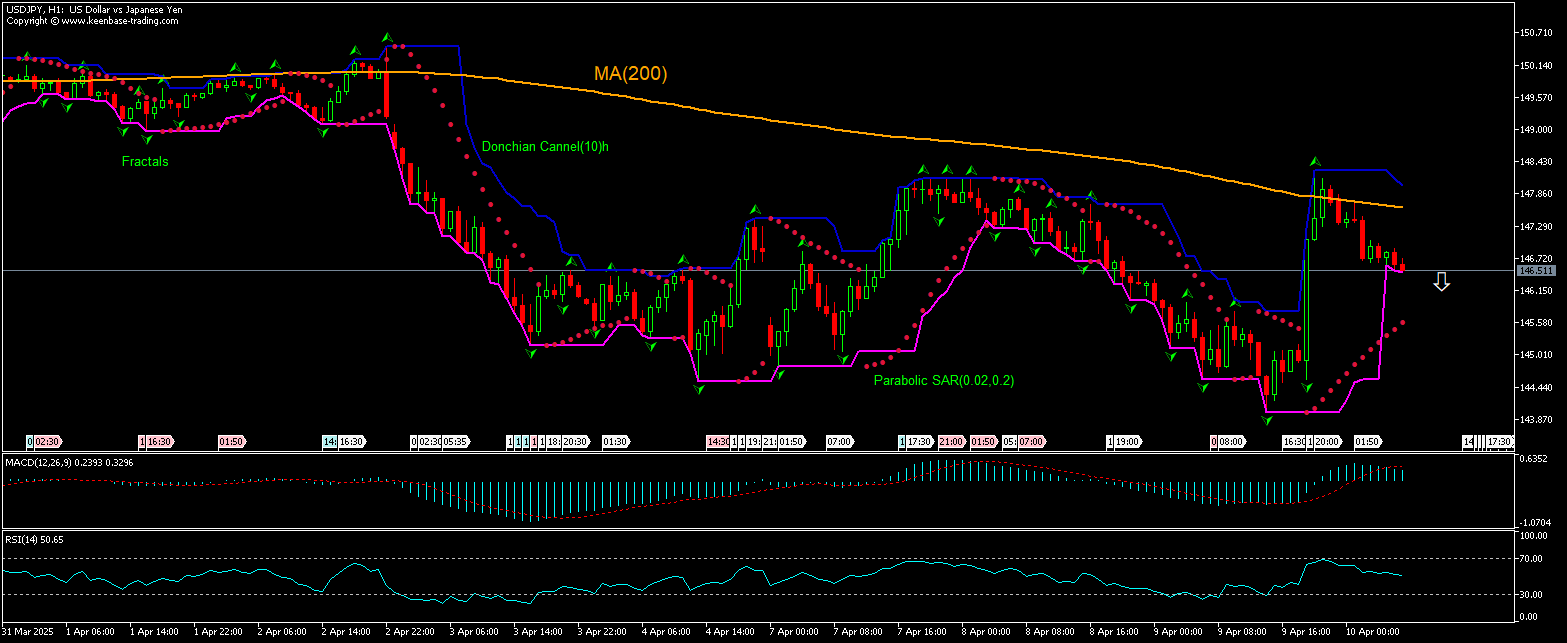

USD/JPY Analisis Teknikal - USD/JPY Berniaga: 2025-04-10

USD/JPY Ringkasan Analisis Teknikal

Below 146.443

Sell Stop

Above 147.613

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Sell |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Buy |

| Donchian Channel | Sell |

USD/JPY Analisis carta

USD/JPY Analisis teknikal

The technical analysis of the USDJPY price chart on 1-hour timeframe shows USDJPY,H1 is retreating after unsuccessful test of the 200-period moving average MA(200) yesterday. We believe the bearish movement will continue after the price breaches below the lower bound of the Donchian channel at 146.443. A level below this can be used as an entry point for placing a pending order to sell. The stop loss can be placed above 147.613. After placing the order, the stop loss is to be moved to the next fractal high , following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Forex - USD/JPY

Japan’s producer prices inflation accelerated in March. Will the USDJPY price decline?

Japan’s producer prices inflation accelerated in March: the Bank of Japan reported Japan's Producer Price Index (PPI) growth ticked up to 4.2% over year in March after 4.1% growth in February, when a decline to 3.9% rate was expected. It was the 49th straight month of producer inflation, with prices rising further for most components led by non-ferrous metals (12.3% vs 13.4%), and petroleum and coal (8.6% vs 5.9% and 4.7%). Producer prices grew by 0.4% over month, accelerating from 0.2% increase in February and marking the steepest rise in three months. Higher than expected Japan’s producer prices inflation is bullish for yen and bearish for USDJPY currency pair.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.