- Analisis

- Analisis Teknikal

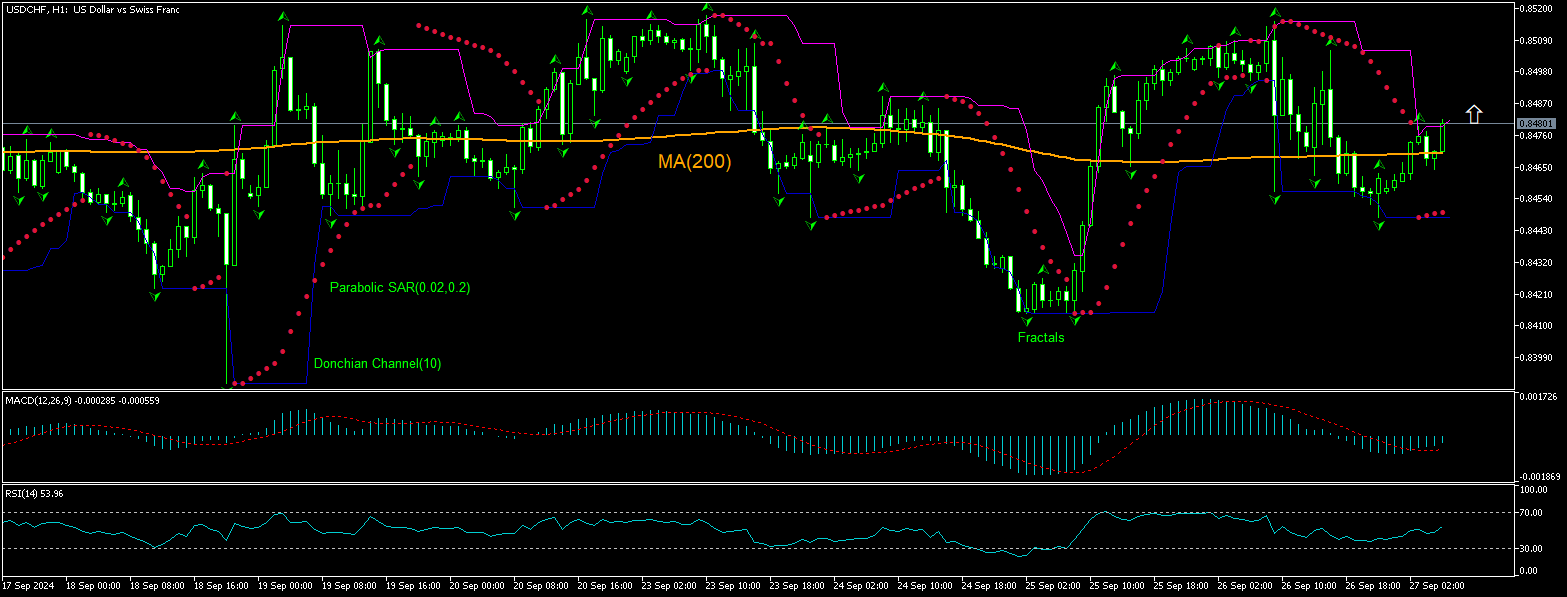

USD/CHF Analisis Teknikal - USD/CHF Berniaga: 2024-09-27

USD/CHF Ringkasan Analisis Teknikal

Above 0.84889

Buy Stop

Below 0.84634

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Buy |

| Donchian Channel | Buy |

| MA(200) | Buy |

| Fractals | berkecuali |

| Parabolic SAR | Buy |

USD/CHF Analisis carta

USD/CHF Analisis teknikal

The technical analysis of the USDCHF price chart on 1-hour timeframe shows USDCHF,H1 has breached above the 200-period moving average MA(200) after rebounding following a decline to two-day low yesterday. We believe the bullish momentum will continue after the price breaches below the upper bound of the Donchian channel at 0.84889. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 0.84634. After placing the order, the stop loss is to be moved to the next fractal low indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Forex - USD/CHF

Swiss investor confidence deteriorated again in September. Will the USDCHF price rebounding reverse?

Swiss investors' sentiment deteriorated again in September: the Union Bank of Switzerland (UBS) reported its Economic Expectations index fell to -8.8 from -3.4 in August. Readings above 0.0 indicate optimism, below indicate pessimism. Swiss investors’ sentiment index ventured deeper into negative territory after entering it last month. The negative reading reflected a grow pessimism for the Swiss economy’s growth outlook over the next six months. Expectations for weaker performance of Swiss economy is bearish for the Swiss franc and bullish for USDCHF currency pair. The next day after UBS report on Economic Expectations the Swiss National Bank cut its key policy rate by 25 basis points to 1% in September 2024, a third consecutive reduction. While an interest rate cut by a central bank is bearish for a country’s currency, the Swiss Franc strengthened slightly after the Swiss National Bank cut the key interest rate by 25 bps.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.