- Analisis

- Analisis Teknikal

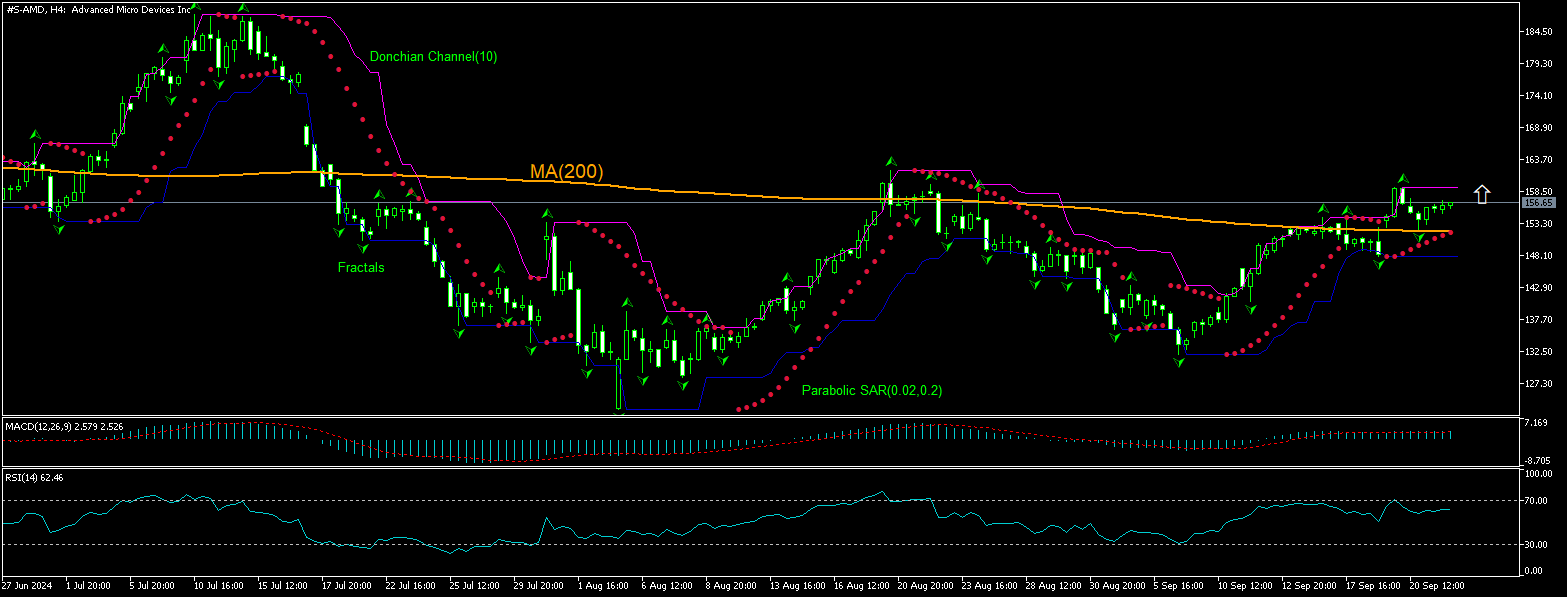

Advanced Micro Devices Inc. Analisis Teknikal - Advanced Micro Devices Inc. Berniaga: 2024-09-24

Advanced Micro Devices Inc. Ringkasan Analisis Teknikal

Above 159.15

Buy Stop

Below 151.00

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | berkecuali |

| Donchian Channel | berkecuali |

| MA(200) | Buy |

| Fractals | Buy |

| Parabolic SAR | Buy |

Advanced Micro Devices Inc. Analisis carta

Advanced Micro Devices Inc. Analisis teknikal

The technical analysis of the AMD stock price chart on 4-hour timeframe shows #S-AMD, H4 is rising as the price breached above the 200-period moving average MA(200) following a rebound after hitting six-week low eighteen days ago. We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 159.15. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 151.00. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (151.00) without reaching the order (159.15), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Saham - Advanced Micro Devices Inc.

AMD stock edged up yesterday after AMD chief predicted a shift from GPUs toward a broader range of chip architectures. Will the AMD stock price resume advancing?

Advanced Micro Devices, Inc. is an American corporation engaged in designing and manufacturing of processors and graphics processing units (GPUs). Nvidia currently dominates the market for GPUs used for running computationally intensive AI workloads. But AMD's Instinct MI300 series accelerators provide a viable alternative to Nvidia's current H100 GPU, analysts say. AMD chief Lisa Su noted that while GPUs remain the top choice for large language models due to their efficiency in parallel processing, the future will likely see a shift toward a broader range of chip architectures. Recent reports indicated AMD is focusing on the mainstream and mid-range GPUs, abandoning the premium gaming GPU market led by Nvidia that helped Nvidia reach a trillion-dollar valuation. To help with setting a perspective, it should be noted that large cloud providers like Amazon and Google have developed their custom AI chips for internal use. It looks like AMD is abandoning efforts to catch up Nvidia in premium gaming GPU market which was instrumental in Nvidia’s dash to a leading name in the development of AI chips. It is not clear if the shift in AMD strategy to the mainstream and mid-range GPUs and planning to capitalize on a shift in large machine learning models toward a broader range of chip architectures will be really successful. Meantime AMD’s market capitalization rose to $253.7 billion from $161.8 billion in May 2022. At the same time its valuation has stretched: Forward P/E ratio has risen to 29.41 from of 21.10 in May 2022. And according to AMD's latest financial reports and stock price the company's current price-to-earnings ratio (Trailing Twelve Months) is 1306.25. At the end of 2022 the company had a P/E (TTM) ratio of 72.8. High valuation is a downside risk for a company stock. However, the current setup is bullish for AMD stock price.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.