- Analisis

- Analisis Teknikal

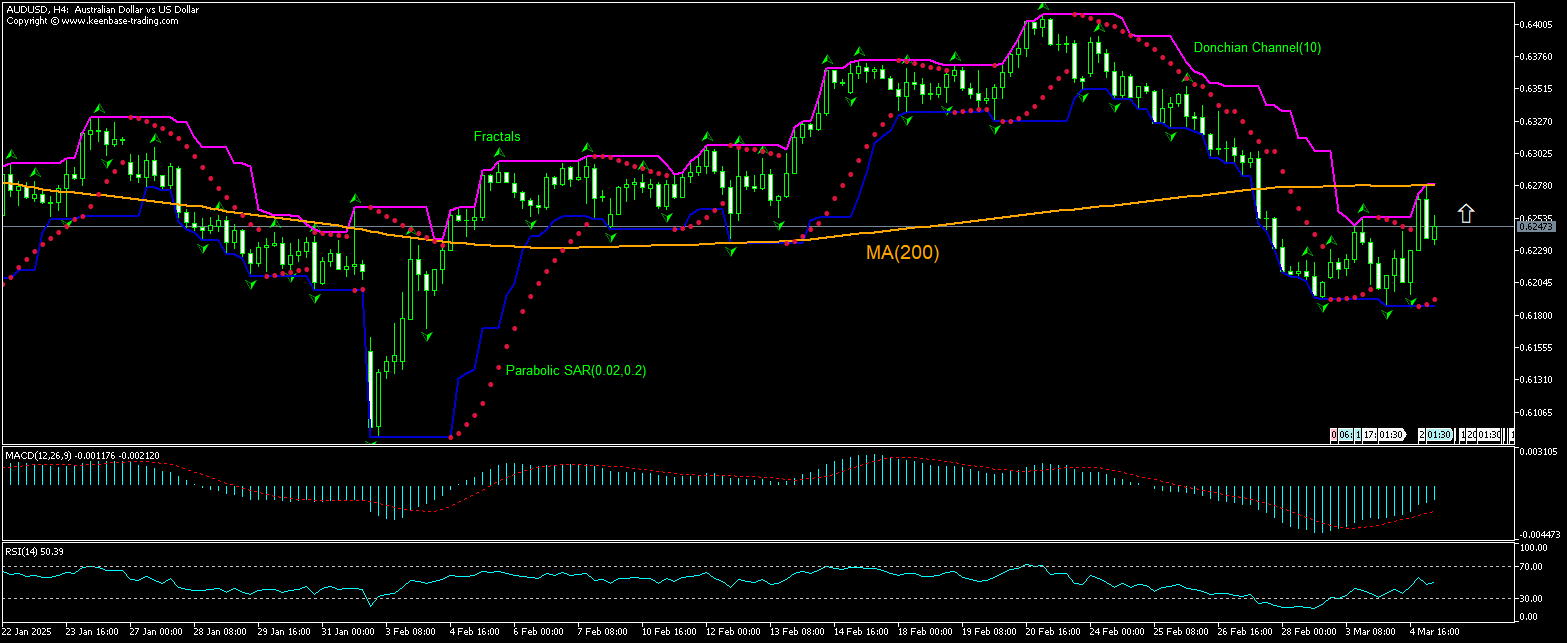

AUD/USD Analisis Teknikal - AUD/USD Berniaga: 2025-03-05

AUD/USD Ringkasan Analisis Teknikal

Above 0.62783

Buy Stop

Below 0.61919

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Buy |

| Donchian Channel | berkecuali |

| MA(200) | Sell |

| Fractals | Buy |

| Parabolic SAR | Buy |

AUD/USD Analisis carta

AUD/USD Analisis teknikal

The AUDUSD technical analysis of the price chart on 1-hour timeframe shows AUDUSD: H1 is retracing up to test the 200-period moving average MA(200) after hitting one-month low yesterday. We believe the bullish momentum will continue after the price breaches above the upper bound of the Donchian channel at 0.62783. A level above this can be used as an entry point for placing a pending order to buy. The stop loss can be placed below 0.61919. After placing the order, the stop loss is to be moved to the next fractal low, following Parabolic indicator signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Forex - AUD/USD

Australian economy growth accelerated in the fourth quarter of 2024. Will the AUDUSD price persist rebounding?

Australian economy growth accelerated in the fourth quarter of 2024. The Australian Bureau of Statistics report indicated Australian gross domestic product (GDP) rose 0.6% over quarter in Q4 after 0.3% growth in Q3 2024. The growth was driven by a rebound in household spending as expenditures on essentials like rent and healthcare continued to rise. Growth of exports of goods and services exceeded increase in imports at 0.7% versus 0.1%, contributing 0.2 percentage points to GDP growth. Private investment also rose, supported by investment in new engineering, electricity infrastructure, and mining. Accelerated expansion of Australian economy is bullish for Australian dollar and AUDUSD currency pair.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.