- Analisis

- Analisis Teknikal

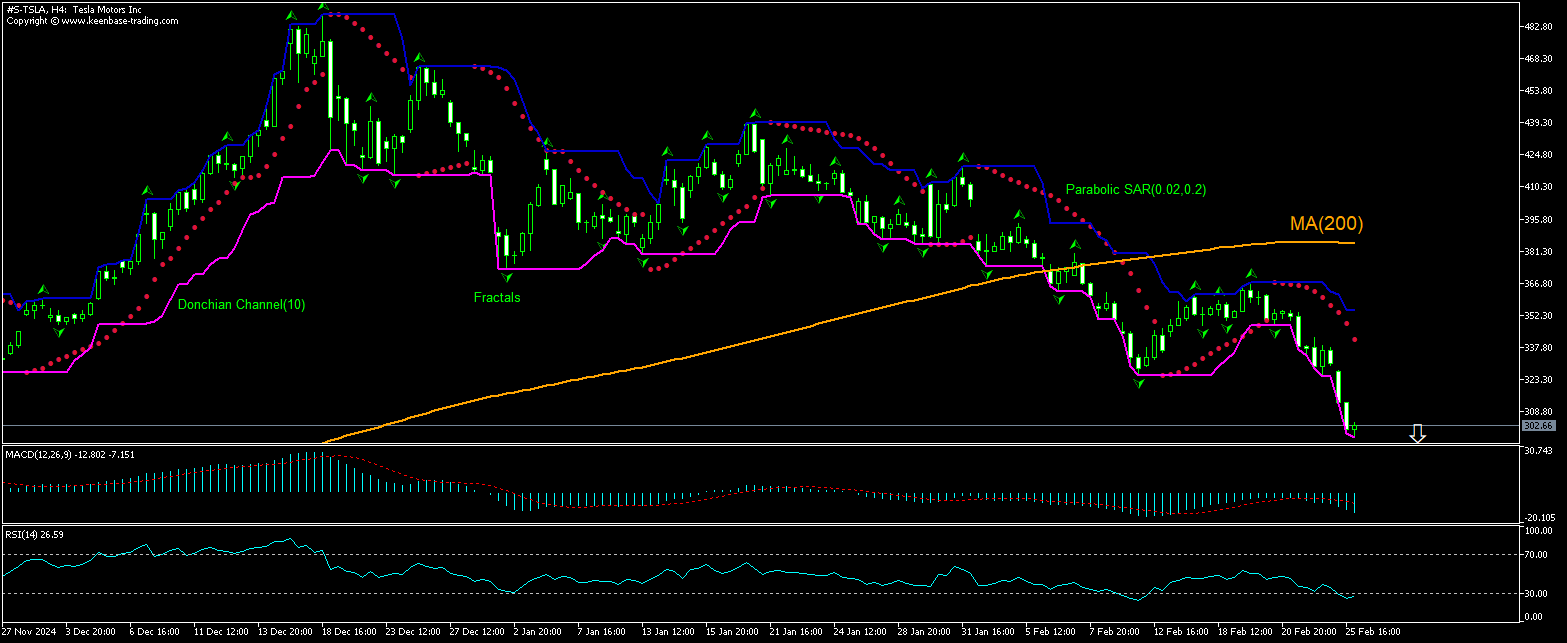

Tesla Motors Inc. Analisis Teknikal - Tesla Motors Inc. Berniaga: 2025-02-26

Tesla Motors Inc. Ringkasan Analisis Teknikal

Below 298.76

Sell Stop

Above 341.51

Stop Loss

| Penunjuk | Isyarat |

| RSI | Buy |

| MACD | Sell |

| Donchian Channel | berkecuali |

| MA(200) | Sell |

| Fractals | Sell |

| Parabolic SAR | Sell |

Tesla Motors Inc. Analisis carta

Tesla Motors Inc. Analisis teknikal

The technical analysis of the Tesla stock price chart on 4-hour timeframe shows #S-TSLA,H4 is retracing down under the 200-day moving average MA(200) after rebounding from six-week low it hit two weeks ago. RSI is in oversold zone. We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 298.76. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed at 341.51. After placing the order, the stop loss is to be moved every day to the next fractal high indicator, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (341.51) without reaching the order (298.76), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Analisis Asas bagi Saham - Tesla Motors Inc.

Tesla stock slumped as sales in Europe plunged in January. Will the Tesla stock price continue retreating?

Tesla stock slumped as sales in Europe plunged in January. Tesla’s new car registrations in the European union, the European Free Trade Association and the UK fell 45.2% over year to 9,945 registrations. And the company’s market share slid to 1% from 1.8% a year earlier, data from the European Automobile Manufacturers' Association showed yesterday. The sales drop came against the backdrop of a 2.1% over year fall in new car registrations in January, with declines in France, Italy, and Germany. However, battery EVs were seen gaining market share in the region with new BEV sales growing by 34% to 124,341 units while petrol car registrations slid 18.9% to 290,301 units. The market share of BEVs rose to 15% from 10.9% a year ago. The decline in Tesla’s sales in Europe came amid increased competition from Chinese rivals and a greater push into the sector from European manufacturers. Decline in vehicle sales is bearish for a carmaker’s stock price. Tesla's stock closed down 8.4% yesterday.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.