- Analisis

- Analisis Teknikal

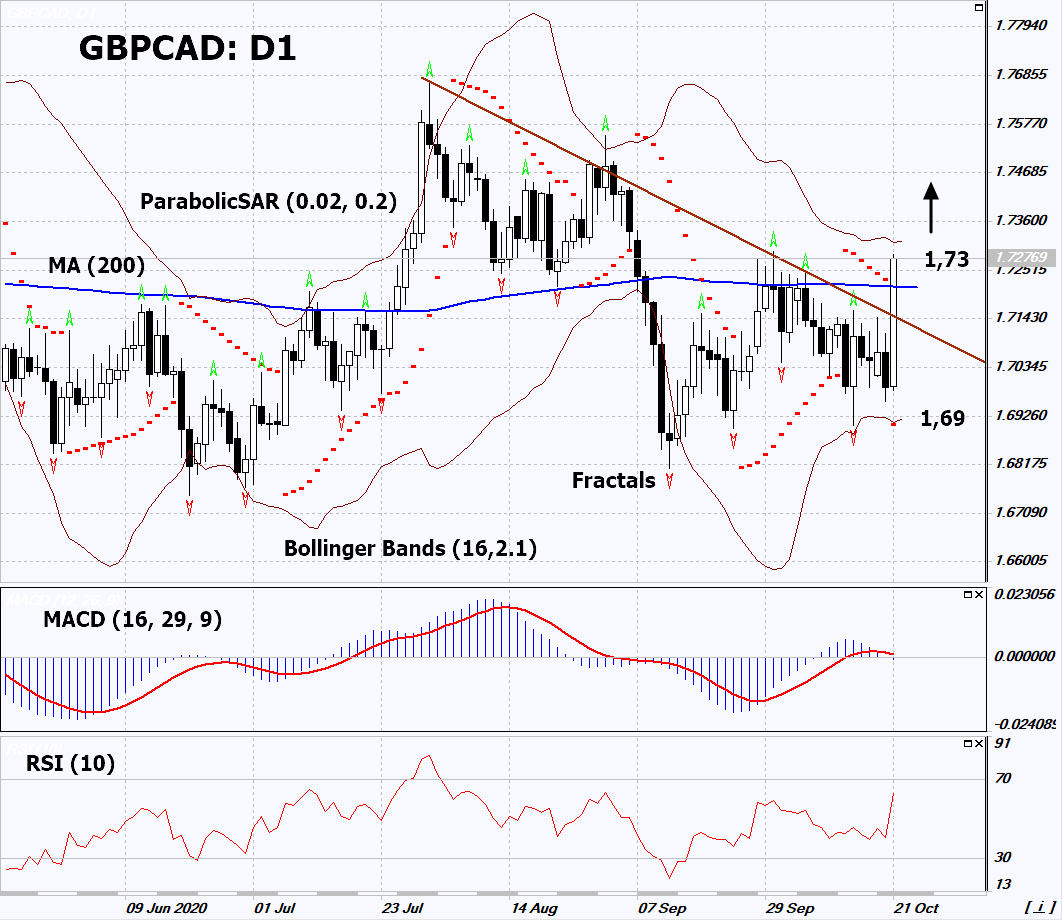

GBP/CAD Analisis Teknikal - GBP/CAD Berniaga: 2020-10-22

GBP/CAD Ringkasan Analisis Teknikal

Above 1,73

Buy Stop

Below 1,69

Stop Loss

| Penunjuk | Isyarat |

| RSI | berkecuali |

| MACD | Sell |

| MA(200) | Buy |

| Fractals | berkecuali |

| Parabolic SAR | Buy |

| Bollinger Bands | Buy |

GBP/CAD Analisis carta

GBP/CAD Analisis teknikal

On the daily timeframe, GBPCAD: D1 breached up the resistance line of the short-term downtrend, as well as the 200-day MA. A number of technical analysis indicators formed signals for further growth. We do not exclude a bullish move if GBPCAD rises above the last three upper fractals: 1.73. This level can be used as an entry point. We can set astop loss below the 200-day moving average line, Parabolic signal, lower Bollinger line and last lower fractal: 1.69. After opening a pending order, we move the stop loss following the Bollinger and Parabolic signals to the next fractal low. Thus, we change the potential profit/loss ratio in our favor. After the transaction, the most risk-averse traders can switch to the 4-hour chart and set a stop loss, moving it in the direction of the bias. If the price meets the stop loss (1.69) without activating the order (1.73), it is recommended to delete the order: some internal changes in the market have not been taken into account.

Analisis Asas bagi Forex - GBP/CAD

Canadian statistics probably indicate a slowdown in economic recovery. Will the GBPCAD quotes continue to grow?

An upward movement signifies the strengthening of the British pound and the weakening of the Canadian currency. The pound strengthened after the EU Council Head Michel Bernier's statement the EU would have to compromise on the Brexit talks to reach a mutual agreement. Investors also perceived a slight increase in inflation in Britain in September, as this may be a sign of economic recovery due to increased consumer demand. They are now awaiting the release of important data on UK retail sales for September and the Markit / CIPS Manufacturing PMI for October on Thursday and Friday this week. The forecasts are positive. In turn, the Canadian dollar weakened slightly amid risks of a decline in world oil prices and negative economic data. Canadian retail sales growth in August in monthly terms (+ 0.4%) was less than expected (+ 1.1%). A regular meeting of the Bank of Canada is scheduled for the next week. Investors fear it may take some measures to ease monetary policy in order to stimulate the Canadian economy.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.