- Analisis

- Sentimen Pasaran

Weekly Top Gainers/Losers: Turkish Lira and Euro

Top Gainers – The World Market

Top Gainers – The World Market

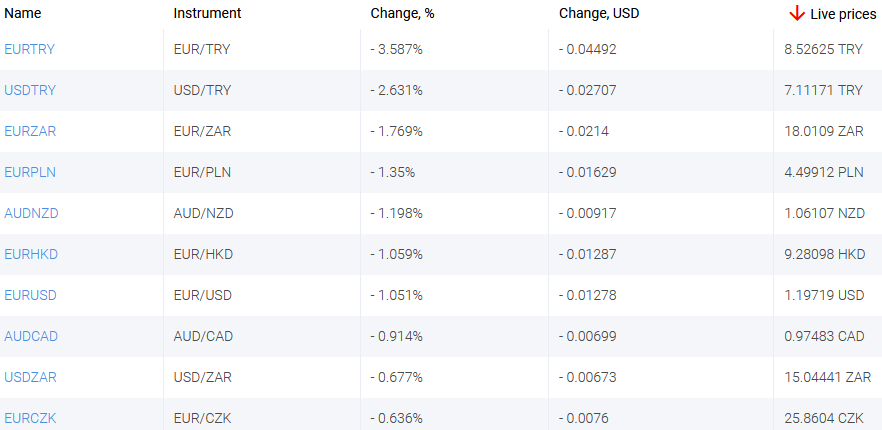

The US dollar has strengthened significantly over the past 7 days. Investors expect new US President Joe Biden's tax initiatives to cut government deficits. Euro fell in price amid weak EU macroeconomic data. Core Inflation Rate YoY in January rose to 1.4%. GDP Growth Rate YoY fell 5.1%. The Turkish lira strengthened due to the rise in the rate of the Central Bank of Turkey at the end of 2020 to 17%. At the same time, the Central Bank of Turkey intends to maintain high rates until 2023 and expects inflation to fall to 10% by the end of 2021.

1.Mitsubishi Motors Corporation, 17,1% – Japanese car company

2. Anglo-American PLC, 13,3% –British mining company

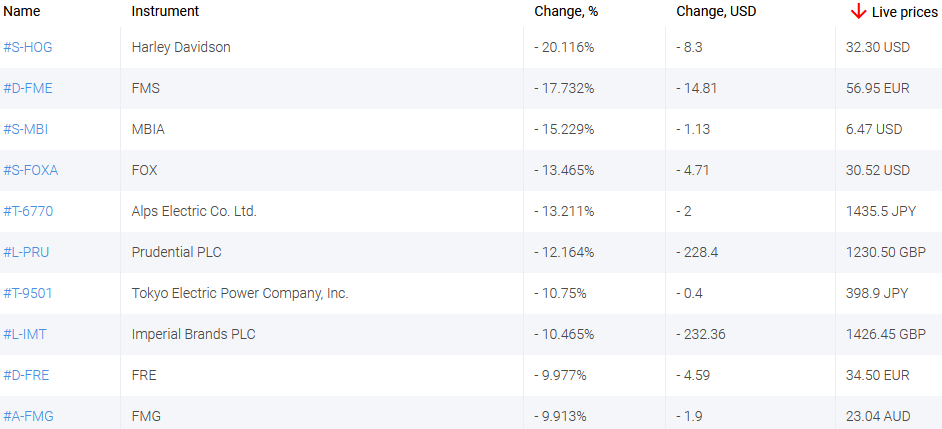

Top Losers – The World Market

Top Losers – The World Market

1. Harley-Davidson, Inc. – American motorcycle manufacturer

2. Fresenius Medical Care AG & Co KGaA – German medical equipment manufacturer

Top Gainers – Foreign Exchange Market (Forex)

Top Gainers – Foreign Exchange Market (Forex)

1. USDCHF, USDSEK - the growth of these charts means the weakening of the Swiss franc and the Swedish krona against the US dollar.

2. USDRUB, USDDKK - the growth of these charts means the strengthening of the US dollar against the Russian ruble and the Danish krone.

Top Losers – Foreign Exchange Market (Forex)

Top Losers – Foreign Exchange Market (Forex)

1. EURTRY, USDTRY - the drop of these charts means the weakening of the euro and the US dollar against the Turkish lira.

2. EURZAR, EURPLN - the drop of these charts means the weakening of the euro against the South African rand and the Polish zloty.

Alat Analisis Khas Baru

Setiap Tempoh Waktu - dari 1 hari sehingga 1 tahun

Setiap Kumpulan Dagangan - Forex, Saham, Indeks, dll.

Perhatian:

Kajian berikut adalah berdasarkan maklumat kognitif dan diterbitkan secara percuma. Semua maklumat, terkandung dalam semakan semasa, diperolehi dari sumber umum, diakui sebagai tidak tepat sepenuhnya. Oleh yang demikian tidak dijamin, maklumat yang dipaparkan adalah tepat dan lengkap sepenuhnya. Ulasan kemudian tidak dikemaskini. Segala maklumat pada setiap ulasan, seperti ramalan, petunjuk, carta dan seumpama dengannya, hanya disertakan bagi tujuaan rujukan, dan bukan sebagai nasihat kewangan atau cadangan. Kesemua teks dan sebahagian darinya, dan termasuk juga carta, sesama sekali tidak boleh digunakan sebagai cadangan untuk membuat sebarang transaksi untuk sebarang saham. Syarikat IFC Markets dan pekerjanya tidak akan bertanggungjawab di bawah mana-mana keadaan untuk segala tindakan yang diambil oleh sesiapa selepas atau semasa ulasan.

Sentimen terakhir

- 18Mac2021Weekly Top Gainers/Losers: Canadian dollar and Japanese yen

Over the past 7 days, prices for oil, non-ferrous metals and other mineral raw materials decreased but still remained high. As a result, the currencies of the commodity countries strengthened: the Canadian dollar, the Australian and New Zealand dollars, the Mexican peso, and the South African rand. The...

- 10Mac2021Weekly Top Gainers/Losers: Canadian dollar and New Zealand dollar

Оil quotes continued to rise over the past 7 days. Against this background, the currencies of oil-producing countries, such as the Russian ruble and the Canadian dollar, strengthened. The New Zealand dollar weakened after the announcement of negative economic indicators: ANZ Business Confidence and...

- 4Mac2021Weekly Top Gainers/Losers: American dollar and South African rand

Over the past 7 days, oil quotes continued to grow. Precious metals, including gold, fell in price. Against this background, the shares of oil companies increased, the Russian ruble strengthened, the Australian and New Zealand dollars, as well as the South African rand, weakened. The US dollar strengthened...